Welcome to Your Compliance Roadmap

Clarke and Company is focused on ensuring that your business is in compliance with all federal and state insurance laws. Use this page to learn more about recent regulations and more. Click below for more information on our upcoming compliance webinars.

Compliance Requirements

Looking for a specific requirement or group size? Click the icon below. Otherwise, keep scrolling to learn more about your federal employee benefit notice, disclosure, and reporting responsibilities.

Employers with 15 or more employees must additionally comply with the ADA and GINA. Click below for more information.

Employers with 20 or more employees must additionally comply with COBRA requirements. Click below for more information.

Employers with 50 or more employees must additionally comply with FMLA requirements. Click below for more information.

Applicable to All Employers

ACA Documents and Notices

Children's Health Insurance Program Reauthorization Act (CHIPRA)

Employees and dependents who are eligible for health care coverage under an employer-sponsored health plan, but are not enrolled, must be permitted to enroll in the plan if they lose eligibility for Medicaid or CHIP (Children’s Health Insurance Program) coverage or become eligible for a premium assistance subsidy under Medicaid or CHIP.

Employers with 15 or More Employees

In addition to the requirements above, employers with 15 or more employees must comply with the Americans with Disabilities Act and Genetic Information Nondiscrimination Act.

Americans with Disabilities Act

The employment provisions of title I of the ADA apply to private employers, state and local governments, employment agencies and labor unions. Employers with 15 or more employees are covered.

Documents

Genetic Information Nondiscrimination Act

The Genetic Information Nondiscrimination Act of 2008 (GINA) provides broad protections in employment and health coverage against the improper collection, use or disclosure of individuals’ genetic information.

Title I prohibits group health plans and health insurance issuers from discriminating based on genetic information and from collecting genetic information.

Title II, which applies to employers with 15 or more employees, protects job applicants and employees from employment discrimination based on their genetic information.

Documents and Notices

Employers with 20 or more Employees

In addition to the requirements above, employers with 20 or more employees on more than 50 percent of the typical business days during the previous calendar year must comply with COBRA requirements. COBRA Administration is another vital HR responsibility, but it can be complex. Government and church plans are exempt.

COBRA

Documents, Notices, and Forms

Common Questions

Employers who employed 20 or more employees on more than 50 percent of the business days in the prior calendar year are subject to COBRA. Small-employer plans, church plans and governmental plans are not subject to COBRA. However, state and local governments are required to comply with parallel continuation coverage requirements under the Public Health Service Act. Individuals covered under the Federal Employees Health Benefit Program are provided with similar, but not identical, rights to continue coverage.

Employers with 50 or More Employees

In addition to the requirements above, employers with 50 or more employees in 20 or more workweeks in the current or preceding calendar year must comply with Family and Medical Leave Act (FMLA). Complying with the FMLA is an important responsibility for HR and benefit managers. Private sector employers, public agencies, and all public and private elementary and secondary schools must comply with the FMLA.

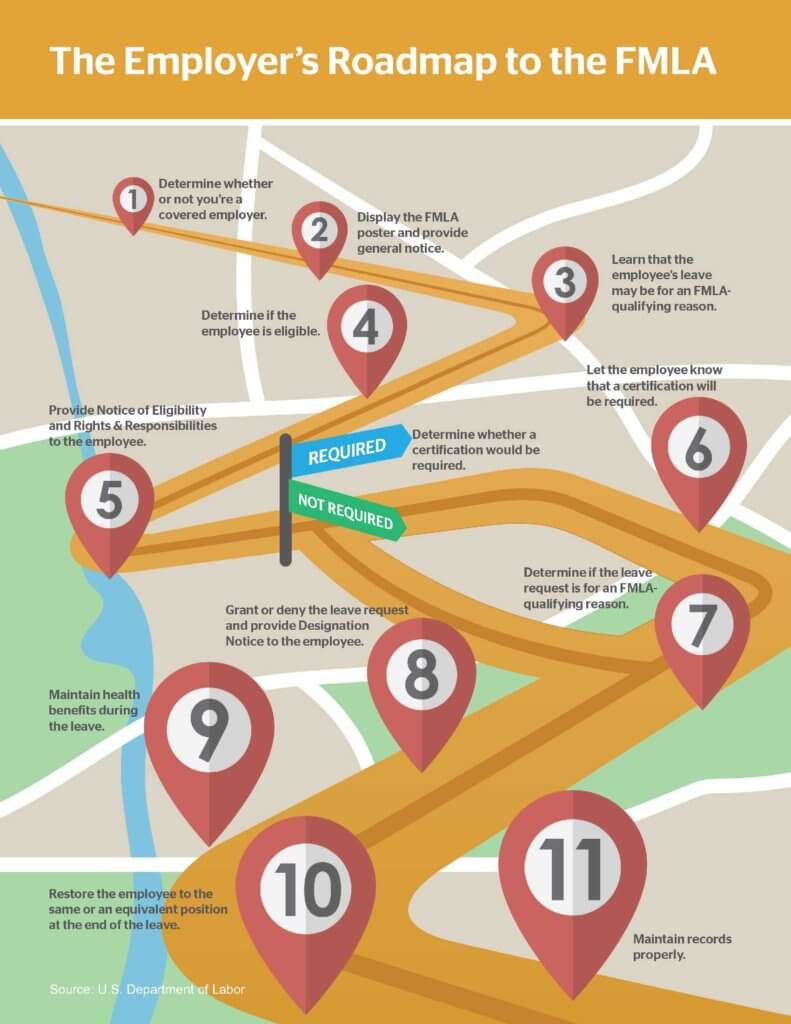

Family and Medical Leave Act

Documents and Notices

Click the image to the right to learn more about the steps you should take as an employer to ensure that you are complying with FMLA requirements.

Common Questions

The FMLA applies to private employers with 50 or more employees on each working day during each of 20 or more calendar workweeks in the current or preceding calendar year. It is not necessary that an employee actually performs work on each working day or receives compensation for the week to be counted as employed, as long as the employee’s name appears on the employer’s payroll. Employees on leave are counted as employed if the employer has a reasonable expectation that they will return to active employment.

Do you offer prescription drug coverage?

Medicare Part D governs group health plan sponsors that provide prescription drug coverage, except entities that contract with or become a Part D plan. Assist your clients in staying in compliance with Medicare Part D legal requirements with the resources below.

Medicare Part D

Common Questions

A group health plan’s prescription drug coverage is considered creditable if it is at least as generous as Medicare Part D prescription drug coverage. There are two permissible methods to determine whether coverage is creditable —a simplified determination method and an actuarial determination method.

Documents, Notices, and Forms

Do you offer pre-tax plans?

Section 125 plans are a common and attractive way to administer benefits, allowing employees to contribute premium or other plan contributions pre-tax. However, these plans must comply with specific IRS regulations. Learn more about these regulations with the informational pieces below.

Section 125

Do you offer welfare benefit plans?

The Employee Retirement Income Security Act of 1974 (ERISA) governs employee welfare benefit plans, unless exempted.

Employee Retirement Income Security Act

The Employee Retirement Income Security Act of 1974 (ERISA) is a federal law that sets minimum standards for employee benefit plans maintained by private-sector employers. ERISA includes requirements for both retirement plans (for example, 401(k) plans) and welfare benefit plans (for example, group health plans). ERISA has been amended many times over the years, expanding the protections available to welfare benefit plan participants and beneficiaries.