COBRA Compliance and State Continuation

Who Must Comply?

Most private-sector employers that maintain group health plans for their employees must comply with COBRA’s continuation coverage requirements. This includes, for example, corporations, partnerships and tax-exempt organizations. However, COBRA does not apply to group health plans maintained by small employers. A “small employer” means an employer that had fewer than 20 employees on 50% of typical business days during the preceding calendar year.

COBRA also applies to plans sponsored by state and local governments. It does not apply, however, to plans sponsored by the federal Government or by churches and certain church-related organizations.

Maximum Length

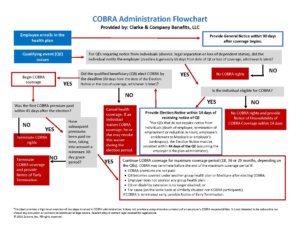

COBRA requires that continuation coverage extends from the date of the qualifying event for a limited period of time of 18 or 36 months.

18 Months: Termination of employment, reduction of hours

29 Months: Disability

36 Months: Divorce or legal separation, covered employee's death, child's loss of dependent status under plan's terms, entitlement to Medicare, employer bankruptcy (for retirees and their dependents)

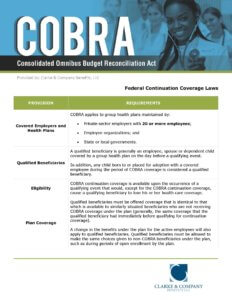

What Plans Apply?

Once an employer determines that it is subject to COBRA, it must look at its plans. An employer-sponsored welfare benefit plan is subject to COBRA if it provides medical care. “Medical care” broadly includes medical, dental, vision and drug coverage. The following table indicates whether welfare benefits commonly offered by employers are subject to COBRA:

Subject to COBRA: Group medical plans, dental and vision plans, health FSAs and HRAs, disease-specific policies (providing medical care), prescription drugs, drug and mental health treatment, hearing care

Not Subject to COBRA: Group life insurance, HSAs, disability plans (long or short-term), AD&D coverage